Retirement can be an exciting new chapter of life, but can also create a level of anxiety around whether you have enough money and how long that money will last.

Try our “Money Life Calculator”

How long will your savings last into Retirement?

Retirement can be an exciting new chapter of life, but can also create a level of anxiety around whether you have enough money and how long that money will last.

Try our “Money Life Calculator”

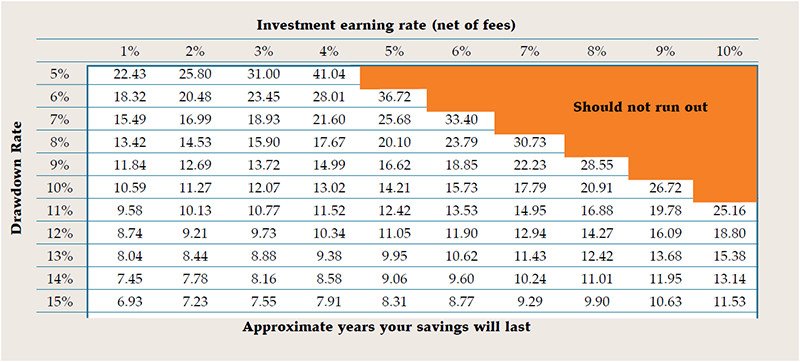

Above you will notice a rather interesting table that we refer to as the Money Life Calculator. Dare if you will, but let’s give it a go together.

To work out the approximate life expectancy of your retirement savings, go down the left hand side to the row that matches the ‘drawdown rate’ that applies to you. next, go along the top to the column which matches the average annual earning rate your investments should achieve (net of fees).

The number you arrive at in the table estimates the number of years your money will last.

Now to make it make sense:

Here’s an example of how to calculate your drawdown rate: Let’s say you have $600,000 in retirement savings and require an income of $54,000 each year. Your drawdown rate is calculated by doing the following:

$54,000 / $600,000 = 9%

If you investments earn 4% after fees, then your money will last around 15 years.

If you want your retirement income to increase with inflation, you can take that into account by subtracting the expected rate of inflation from the earning rate of your investments. For example, if you expect earnings of 7% pa and inflation of 3%pa, then you would select 4% as your ‘real’ earning rate (top line of the table).

The calculator doesn’t take Age Pension entitlements into account, however to include this, you could reduce your drawdown rate by the amount of pension you expect to receive.

Of course, the ‘Money Life Calculator’ is just a graphical guide. To accurately assess the life expectancy of your retirement savings you should talk with our Fortunity financial advisers. They have access to sophisticated software that takes into account all of the variables and calculates taxation and Centrelink benefits each year of our retirement.

It may also be possible to stretch the life expectancy of your retirement savings by implementing one or more of the following strategies:

- Increase your contributions to super before you retire (and possibly use the ‘Transition to Retirement’ rules to create additional tax advantages)

- Arrange your finances so you reduce your tax in retirement

- Increase the return you generate on your investments

- Arrange your finances to qualify for higher Centrelink benefits

- Retire later

- Work part-time in retirement

- Lower your income requirement in retirement

- Decide to leave less or nothing to your estate

For the majority of retirees, the most appropriate solution usually involves multiple strategies. The team at Fortunity would be pleased to model different scenarios for you to ensure the right combination of strategies is employed for your situation and lifestyle needs. Call us today on 4304 8888 to discuss how long your retirement savings can last.